Why the volatility is log-normal and how to apply the log-normal stochastic volatility model in practice | Artur Sepp Blog on Quantitative Investment Strategies

Impact of volatility jumps in a mean-reverting model: Derivative pricing and empirical evidence - ScienceDirect

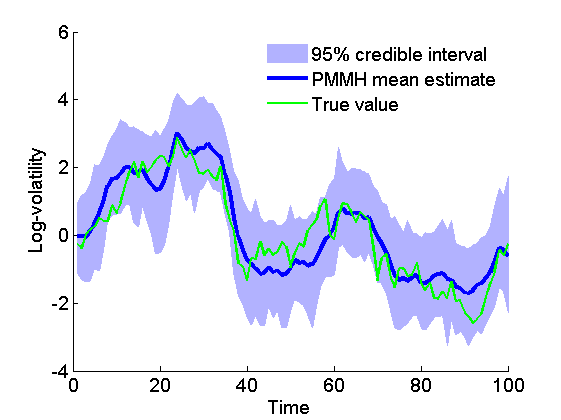

Probabilistic Programming Using PyMC3: TESLA Stock Stochastic Volatility Estimation | by Reza Rashetnia, PhD | Nerd For Tech | Mar, 2021 | Medium